Mr. Fibs - 2/14/24 Market Analysis

Good morning traders and investors. Today’s post is an update of the riggers and levels as well as a plan for intraday. In the analysis, I will quickly mention my thoughts on how the CPI print yesterday is in line with some of the ideas I’ve had earlier this year for the rest of this week, big economic data is jobless claims and PPI. And next week we have FOMC meeting minutes released.

Economic Calendar

WEDNESDAY, FEB. 14

9:30 am Chicago Fed President Austan Goolsbee speaks

4:00 pm Fed Vice Chair for Supervision Michael Barr speaks

THURSDAY, FEB. 15

8:30 am Initial jobless claims

8:30 am Empire State manufacturing survey

8:30 am Philadelphia Fed manufacturing survey

8:30 am Import price index

8:30 am Import price index minus fuel

8:30 am U.S. retail sales

8:30 am Retail sales minus autos

9:15 am Industrial production

9:15 am Capacity utilization

10:00 am Home builder confidence index

1:15 pm Fed Gov. Christopher Waller speaks

7:00 pm Atlanta Fed President Raphael Bostic speaks

FRIDAY, FEB. 16

8:30 am Housing starts

8:30 am Building permits

8:30 am Producer price index

8:30 am Core PPI

8:30 am PPI year over year

8:30 am Core PPI year over year

9:10 am Fed Vice Chair for Supervision Michael Barr speaks

10:00 am Consumer sentiment (prelim)

12:10 pm San Francisco Fed President Mary Daly speaks

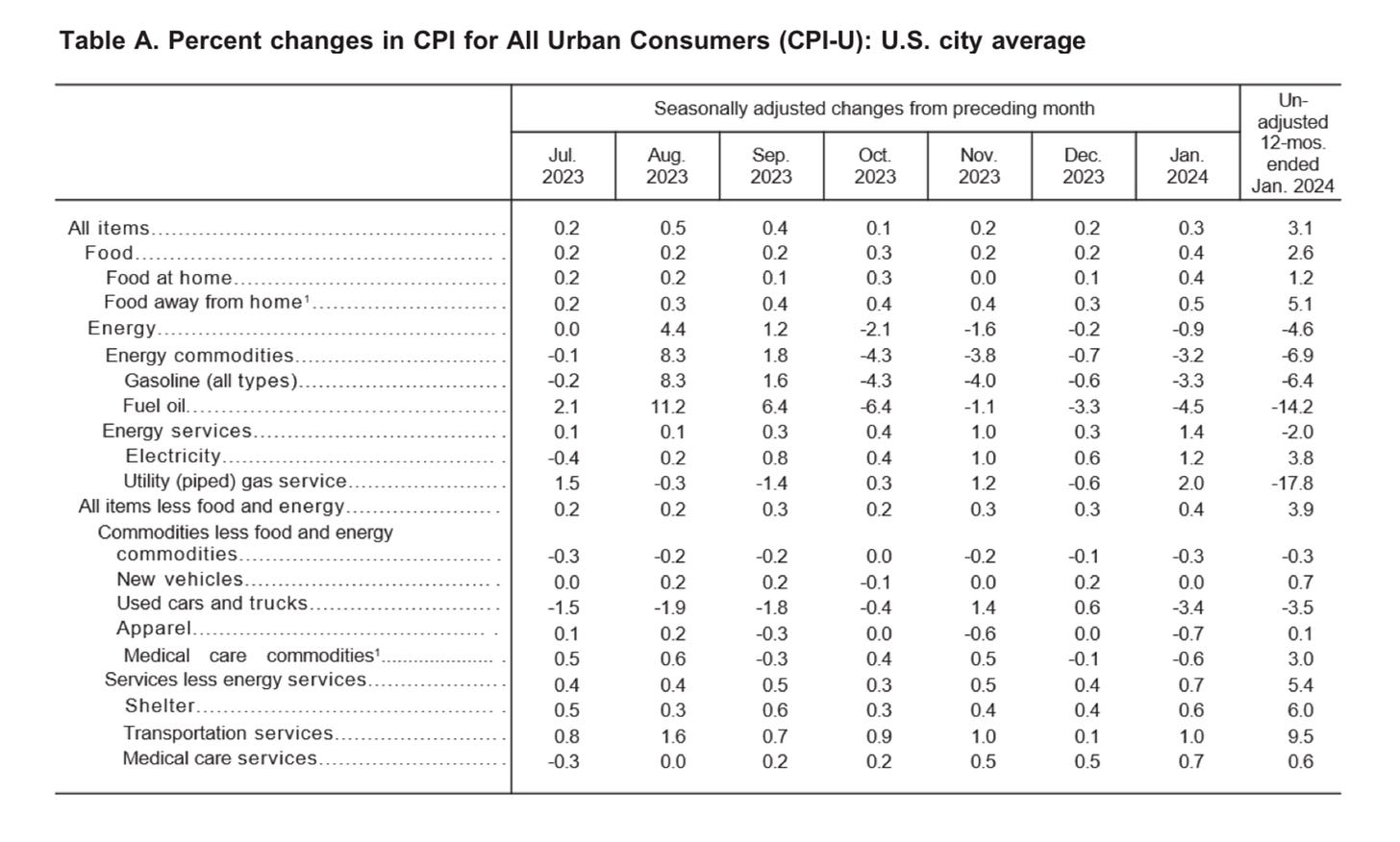

The latest US Consumer Price Index (CPI) data shows a continued rise in inflationary pressures, with the year-over-year (YOY) core CPI coming in at 3.9%, higher than both the forecasted 3.7% and the previous 3.9%. This indicates that inflationary pressures remain elevated, driven by factors such as supply chain disruptions, increased demand, and rising input costs. Additionally, the month-over-month (MoM) core CPI rose by 0.4%, surpassing the forecasted 0.3% and the previous 0.3%, further highlighting the persistent inflationary trend.

US CORE CPI YOY ACTUAL 3.9% (FORECAST 3.7%, PREVIOUS 3.9%)

US CPI MOM ACTUAL 0.3% (FORECAST 0.2%, PREVIOUS 0.3%)

US CORE CPI YOY ACTUAL 3.9% (FORECAST 3.7%, PREVIOUS 3.9%)

US CORE CPI MOM ACTUAL 0.4% (FORECAST 0.3%, PREVIOUS 0.3%)

The higher-than-expected inflation data is likely to reinforce market concerns about the ongoing inflationary pressures and their potential impact on monetary policy decisions. The Federal Reserve has been closely monitoring inflation data as it weighs its policy stance, particularly regarding the timing and pace of interest rate hikes. The latest CPI figures may prompt the Fed to consider more aggressive measures to address inflation, such as tightening monetary policy sooner than anticipated.

In response to the elevated inflation readings, market participants may adjust their expectations for future Fed actions, leading to increased volatility in financial markets. Investors may also reassess their investment strategies, favoring assets that historically perform well during periods of inflation, such as commodities and inflation-protected securities. Additionally, higher inflation could put further pressure on bond yields, impacting fixed-income investments. Therefore, it's crucial for investors to stay vigilant and adapt their portfolios accordingly in response to evolving market conditions.

Levels and Analysis

Keep reading with a 7-day free trial

Subscribe to Mr. Fibs's Newsletter to keep reading this post and get 7 days of free access to the full post archives.