Mr. Fibs - 6/3/24 Market Analysis

Good morning traders and investors. Today’s just mostly functions as a formal post where I can reshare some of the ideas I have mentioned this recently in the Discord and Twitter community. Before I dive into this week’s calendar, notable earnings, key events and my new YT video for all subscribers, I wanted to reshare last week’s PCE data.

US PCE PRICE INDEX YOY ACTUAL 2.7% (FORECAST 2.7%, PREVIOUS 2.7%)

US PCE PRICE INDEX MOM ACTUAL 0.3% (FORECAST 0.3%, PREVIOUS 0.3%)

US CORE PCE PRICE INDEX YOY ACTUAL 2.800004% (FORECAST 2.76%, PREVIOUS 2.8%)

US CORE PCE PRICE INDEX MOM ACTUAL 0.2% (FORECAST 0.25%, PREVIOUS 0.3%)

For this week the key events we have are Manufacturing PMI, JOLTs, Jobless Claims, NFP, and NVDA stock split. Although these are next week, I would keep in mind we also have CPI, PPI, and Fed meeting minutes again next week. For now, the Fed is in a blackout period until the release of those minutes.

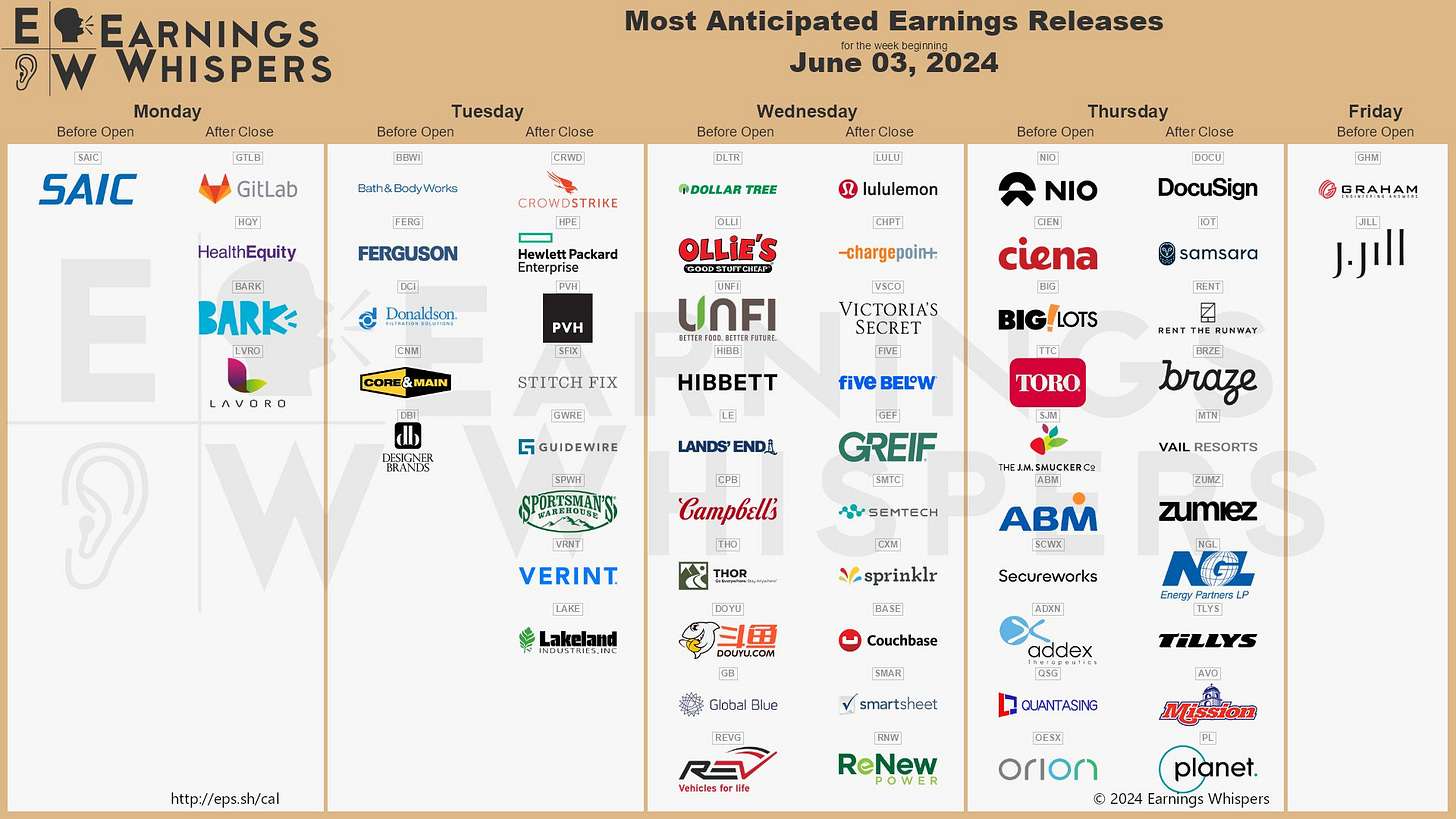

Notable earnings this week include GTLB, CRWD, LULU, DLTR, FIVE, DOCU, and NIO.

We have PMI early in today’s cash session. Slight gap below us as we set up for price to also possibly open in the gap between May 28th close and May 29th open.

Economic Calendar

MONDAY, JUNE 3

9:45 am S&P flash U.S. manufacturing PMI

10:00 am Construction spending

10:00 am ISM manufacturing

TBA Auto sales

TUESDAY, JUNE 4

10:00 am Factory orders

10:00 am Job openings

WEDNESDAY, JUNE 5

8:15 am ADP employment

10:00 am ISM services

8:30 am U.S. productivity (final revision)

8:30 am U.S. trade deficit

9:45 am S&P flash U.S. services PMI

THURSDAY, JUNE 6

8:30 am Initial jobless claims

FRIDAY, JUNE 7

3:00 pm Consumer credit

10:00 am Wholesale inventories

8:30 am U.S. employment report

8:30 am U.S. unemployment rate

8:30 am U.S. hourly wages

8:30 am Hourly wages year over year

For today, I also wanted to share my new youtube video. I am not sure if it will be fully rendered and uploaded by the time I publish today, but I will certainly embed it below in today’s post. I will also share the link in our free discord and on social media so keep a look out.

Levels and Analysis

So today I really wanted to give you guys the update chop zones we could confirm. I hope the educational video is useful and you guys have a better ideas of how to determine swing ranges and confluence zones.

Coming into this week, I have a clear mind and I am not too focused on establishing major swing trades based on my biases. Personally, I know that I would rather enter swings post NFP and next week’s rate decision while letting the dip buying and positions I’ve built work for me in the interim if we are continuing upward.

That being said, this is my idea for the week.

Keep reading with a 7-day free trial

Subscribe to Mr. Fibs's Newsletter to keep reading this post and get 7 days of free access to the full post archives.