Mr. Fibs - 7/14/24 Market Analysis

Hey traders and investors. This week I wanted to share updated chop zones and levels with a brief general recap of some things I have discussed in the Discord and videos posted last week.

Before doing so I wanted to highlight the economic calendar and earnings for the week, as usual.

Notable earnings this week include GS, BLK, BAC, MS, SCHW, IBKR, UNH, JBHT, UAL, JNJ, ASML, AA, KMI, TSM, NFLX, DPZ, NOK, BX, DHI, ABT, AXP, SLB, and HAL. In particular, I will be watching the guidance for TSM as it could affect the semis.

For the economic calendar, I will be paying attention to housing starts, mostly because housing and industrials could be the focus as it pertains to a “rate cut trade.” Although I think the rate cut trade truly was at the start of March, small caps were able to move out of consolidation in anticipation of rate cut expectations after the CPI last Thursday, so there may be other sectors that may finally come around.

Economic Calendar

MONDAY, JULY 15

8:30 am Empire State manufacturing survey

12:00 pm Fed Chairman Powell speaks

TUESDAY, JULY 16

8:30 am U.S. retail sales

8:30 am Retail sales minus autos

8:30 am Import price index

8:30 am Import price index minus fuel

10:00 am Business inventories

10:00 am Home builder confidence index

2:45 pm Fed Gov. Adriana Kugler speaks

WEDNESDAY, JULY 17

8:30 am Housing starts

8:30 am Building permits

9:15 am Industrial production

9:15 am Capacity utilization

2:00 pm Fed Beige Book

THURSDAY, JULY 18

8:30 am Initial jobless claims

8:30 am Philadelphia Fed manufacturing survey

10:00 am U.S. leading economic indicators

FRIDAY, JULY 19

10:40 am New York Fed President Williams speaks

1:00 pm Atlanta Fed President Raphael Bostic speaks

Last week, I mentioned that small caps had a key level to watch at 2050 on RTY in Discord, and if there was a “tradeable top” for the market, that we would confirm below on HTFs. Although we saw below briefly, the CPI reaction gave small caps a sizable move removing that scenario when the daily was able to close above its quarterly pivot. From there we were able to discuss before PPI, that a broadening of a rally in indices outside of SPX and NDX is usually a good sign and we did see that dips continued to get bought.

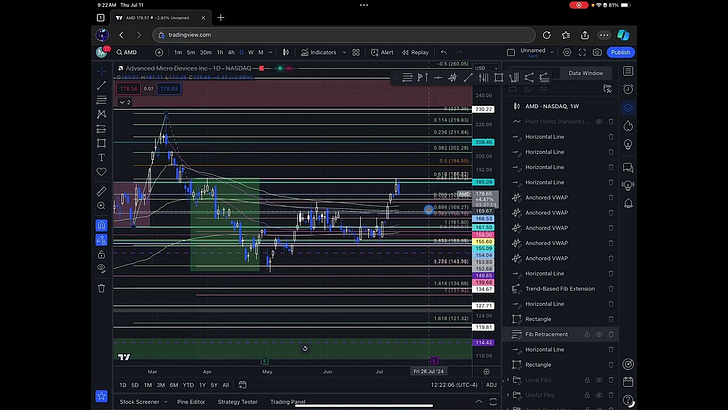

Indexes remain above emas on the daily with shorter emas above the longer ones. In the analysis, I will further discuss some setups and things to look for, but the main focus will be the newly derived chop zones I have for you guys on SPY. I will also attach links to the videos from last week for subscribers who want a refresher on the topics and charts mentioned.

Have a great trading week!

Levels and Analysis

Into this week, I won’t focus too much on triggers/pivots as I think outlining our new chop zones and main levels is a bit more important. If have more ideas for intraday plans or longer timeframe ideas, I will strictly post them in the discord.

For chop zones and levels, we are now working with:

Keep reading with a 7-day free trial

Subscribe to Mr. Fibs's Newsletter to keep reading this post and get 7 days of free access to the full post archives.