Good morning traders and investors. Today I wanted to share the general trade plan and ideas I have with everyone. Not much of an update for our main levels from the beginning of the week, but I will add a couple more for paid subs at the bottom of the post.

So we got a bounce into the session open which is typical out of a plunge day. The question now for many is do we bounce/range or are lows not completely in? Instead of focusing on that purely I also want to highlight how we can use this move to find an edge at this point in the market.

I still think the big thing to watch for this session in particular are market internals. I’ve highlighted how you could see the hedging in VIX before we got the down move. So if VIX were to have a sizeable down move, it could allude to the pullback being over. This is because we have been bullish and a lot of participants surely still have a bullish outlook.

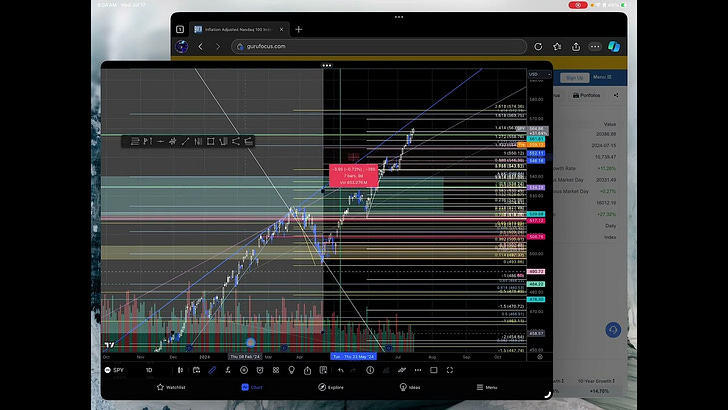

On Nasdaq we rejected weekly R2 as a high, traded below the pivot, and down to weekly S2. For chips, I would maybe like to see the sector trade its pivot below on the monthly pivots for a decent opportunity to enter trades. Shared in levels below.

So watch for if smart money reduces those hedges that they front ran pretty well. Possibly a dip situation on VIX, for a bounce and lower high into next week. This would give solid opportunities for swings IMHO.

A bounce and lower is my preferred path for now, especially with speculators supper giddy about the recovery in some names. Like I said in the video, bottoms typically occur when those short timeframe trend traders have a really poor outlook as well as value investors still struggling with their paper cuts. A lot of calls for major bottoms from a 1-day move suggest that some value and longer timeframe investors may not have dealt with or gotten frustrated with the paper cuts quite yet.

The ideal path, for now, is to bounce and then lower Friday, but market internals and technicals will dictate a lot. I still think we are in an overall bullish trend. I’ll be using today to see what holds up well, and then if we are weaker or trade lower, we can find the names that have relative weakness on a new low for trades into next week.

Lots of eyes on Dow Jones now, which was able to get to a whopping R3 on the monthly. Could see some profit taking there too.

Have a great trading day! Check out my most recent video for some education on how and why we saw the move we did. Also talked about general markets and debunking Bull vs. Bear as Value Investors vs Trend Traders.

Levels

Keep reading with a 7-day free trial

Subscribe to Mr. Fibs's Newsletter to keep reading this post and get 7 days of free access to the full post archives.